HVCU Value

HVCU Value

Business Checking

$0 or $10 low balance fee.

Low balance fee waived when you maintain a balance of $2,500.

HVCU Enhanced

HVCU Enhanced

Business Checking

$0 or $20 low balance fee.

Low balance fee waived when you maintain a balance of $7,500.

Money Market

Money Market

Accounts

A secure investment with the flexibility of a checking account.

Explore account options.

Why Hudson Valley Credit Union?

As your financial partner, you can be sure that your business checking account will work as hard as you do. We’re locally established and community-focused with the competitive products and services you’ll need to achieve your business goals.

Business account that puts you in control

Full transparency so both small businesses and large corporations can manage cash flow, deposits, and transfers with lower fees than commercial banks.

Accessibility and locality

39 regional branches and 85,000+ surcharge-free nationwide ATMs.

Real people, real results

In-branch business support, live chat, and local customer service reps.

Secure business banking

Fraud monitoring, custom account alerts, and more keep your funds safe.

Compare Business Checking Accounts and Find the Best Fit

| Checking Account Feature | Value Business Checking | Enhanced Business Checking |

|---|---|---|

| Average Daily Balance | $2,500

|

$7,500

|

| Access to Over 85,000+ Surcharge-Free ATMs Nationwide | X

|

X

|

| Cash Deposits | X

|

X

|

| Internet Banking & Mobile Banking | X

|

X

|

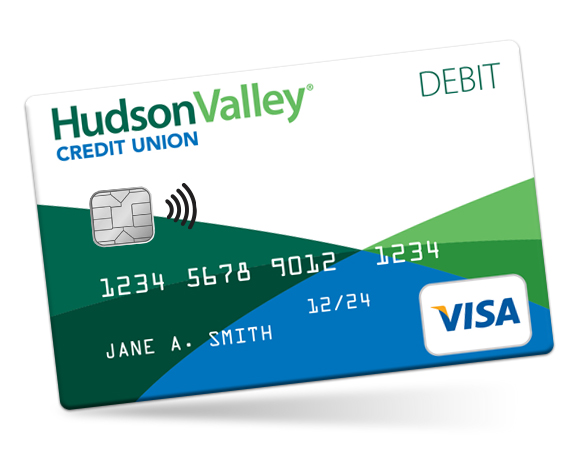

| Visa Debit Card with Rewards | X

|

X

|

| Toll-Free Contact Center Service | X

|

X

|

| Remote Deposit Capture | X

|

X

|

| Domestic & International Wire Transfers | X

|

X

|

| HVCU Fee Waived at Non-HVCU ATMs | 12 / month

|

12 / month

|

| Daily Dividends | Dot Icon here | X

|

| No Charge for Bill Pay | Dot Icon here | X

|

| No Charge for Official Checks | Dot Icon here | X

|

| No Charge for Guaranteed Checks | Dot Icon here | X

|

| Discounts with One or More of Our Business Services | X

|

N/A

|

Business Checking Features That Help Your Business Grow

- Easily switch your accounts over to HVCU with ClickSWITCH

- Manage your business banking online with Internet Banking and Mobile Banking through the HVCU app

- Online and mobile Bill Pay

- Night deposit boxes

- Visa® Debit Reward Cards for you and your employees

- Contactless payments and purchases with your Visa Business Debit Card and Mobile Wallet

- Secure purchasing with Visa Secure and Online Checkout with Visa

What Do You Need to Open a Business Checking Account?

- Your Social Security Number or Business Tax ID

- Legal business name and DBA (“doing business as”) name

- Date of establishment

- Personal identification, such as a Driver’s License or passport

- Certificate of assumed name

- Business formation documents

- Ownership agreements

Check Out Our Other Business Account Options

![]()

IOLA Checking

Manage your client’s funds with ease, affordability, and tiered dividend rates.

![]()

Specialized Business Accounts

Hudson Valley Credit Union is here to ensure that businesses in the region can participate and thrive in their industry, with the business banking that best meets their needs.

![]()

Business Services

Optimize business performance and get the support you need to make your business goals attainable.

Your Money Is Protected

Accounts at HVCU are Federally Insured for up to $250,000. Share insurance coverage is provided by the National Credit Union Administration (NCUA), an independent government agency that charters, regulates and insures federal credit unions. Visit mycreditunion.gov to learn more about your Share Insurance Coverage.

What Your Neighbors Are Saying

We Are Here To Help

Important Legal Disclosures & Information

Visa is a registered trademark of Visa International Service Association.